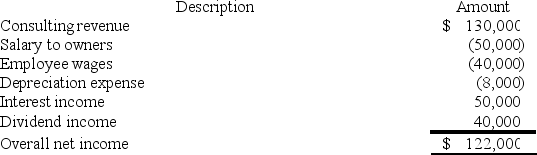

RGD Corporation was a C corporation from its inception in 2014 through 2017. However, it elected S corporation status effective January 1, 2018. RGD had $50,000 of earnings and profits at the end of 2017. RGD reported the following information for its 2018 tax year.

What amount of excess net passive income tax is RGD liable for in 2018? (Round your answer for excess net passive income to the nearest thousand).

What amount of excess net passive income tax is RGD liable for in 2018? (Round your answer for excess net passive income to the nearest thousand).

Definitions:

First Class

The highest quality of service or seating available, typically offering more space, comfort, and amenities, often found in transportation and accommodations.

Second Class

A category of service or ticket in transportation or other services that is below the highest level in terms of amenities and cost.

Miles Traveled

The total distance covered or traveled, often used in contexts like transportation studies, expense calculations, or travel statistics.

Perfect Substitutes

are goods that can be completely exchanged for one another at a constant rate of substitution and possess identical levels of utility and functionality for consumers.

Q6: A taxpayer always will have a tax

Q10: Which of the following statements is correct

Q17: Which of the following is not a

Q24: Under what conditions will a partner recognize

Q37: Mike and Michelle decided to liquidate their

Q67: The gross profit from a sale of

Q89: On 12/31/X4, Zoom, LLC reported a $60,000

Q89: Tuna Corporation reported pretax book income of

Q94: The gross estate may contain property transfers

Q121: At her death Tricia had an adjusted