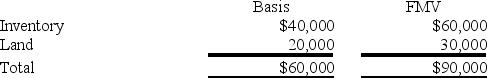

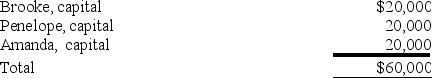

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

Example

A representative case or instance used to illustrate a rule, method, or condition; often used for clarification.

Stanley Milgram

A psychologist best known for his groundbreaking research on obedience to authority, highlighting the powerful influence of authority figures on individual actions.

Conformity

The act of matching attitudes, beliefs, and behaviors to group norms, values, or expectations.

Classic Experiment

a traditional or well-established form of experimental research that tests hypotheses under controlled conditions to establish cause and effect relationships.

Q18: General Inertia Corporation made a distribution of

Q29: Which of the following statements best describes

Q38: Once determined, an unrecognized tax benefit under

Q46: Provo Corporation, a U.S. corporation, received a

Q57: Natsumi is a citizen and resident of

Q74: Casey transfers property with a tax basis

Q80: Biggain Corporation distributes land with a fair

Q82: Which of the following is not calculated

Q85: Guaranteed payments are included in the calculation

Q99: Which of the following describes the correct