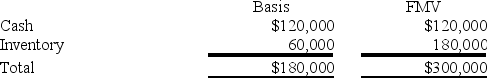

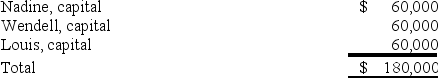

Nadine Fimple is a one-third partner in the NWL Partnership with equal inside and outside bases. On January 1, NWL distributes $100,000 to Nadine in complete liquidation of her FPL interest. NWL's balance sheet as of January 1 is as follows:

What is the amount and character of Nadine's recognized gain or loss on the distribution?

What is the amount and character of Nadine's recognized gain or loss on the distribution?

Definitions:

Gross Investment

The total amount spent on purchasing or constructing new capital goods over a specific time period, without accounting for depreciation.

Net Investment

Net investment refers to the total amount spent on purchasing new capital minus the depreciation on existing capital, indicating the growth of a company or economy's productive capacity.

Capital Goods

Long-lasting goods acquired and used by businesses to produce other goods and services, contributing to their operational capabilities.

Gross Investment

The total amount spent on purchasing or constructing new capital assets before accounting for depreciation.

Q25: Half Moon Corporation made a distribution of

Q30: The SSC Partnership balance sheet includes the

Q57: Daniel acquires a 30% interest in the

Q67: The state tax base is computed by

Q70: Most corporations use the annualized income method

Q70: Gordon operates the Tennis Pro Shop in

Q71: The "double taxation" of corporate income refers

Q73: If Annie and Andy (each a 30%

Q89: Generally, before gain or loss is realized

Q98: Which of the following statements regarding the