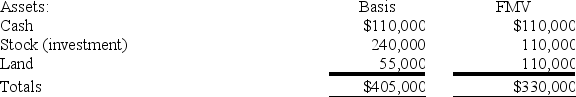

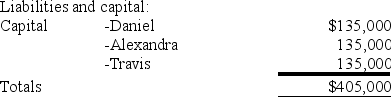

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Average Product

The output per unit of input, such as labor or machinery, typically used in the context of analyzing production efficiency.

Marginal Cost

The increase in total cost that results from producing one additional unit of a good or service.

Total Cost

The total economic cost of production, including both fixed and variable costs.

Average Total Cost

Total cost divided by the number of units produced, representing the cost per unit of output.

Q18: Hector formed H Corporation as a C

Q19: Partners must generally treat the value of

Q44: Phillip incorporated his sole proprietorship by transferring

Q51: In December 2017, Jill incurred a $50,000

Q60: Orono Corporation manufactured inventory in the United

Q65: The City of Boston made a capital

Q75: Which of the following is a requirement

Q76: Which of the following assets would not

Q78: Morgan Corporation determined that $2,000,000 of the

Q87: Boca Corporation, a U.S. corporation, received a