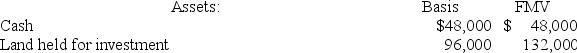

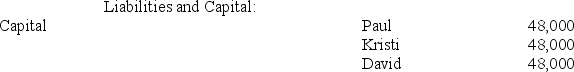

Kathy purchases a one-third interest in the KDP Partnership from Paul for $60,000. Just prior to the sale, Paul's outside and inside bases in KDP are $48,000. KDP's balance sheet includes the following:

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

If KDP has a §754 election in place, what is Kathy's special basis adjustment?

Definitions:

Gift Inter Vivos

A legal term for a gift given during the lifetime of the giver, transferring ownership immediately.

Legal Ownership

The lawful possession of property, characterized by rights such as transfer, use, and exclusion, recognized and enforced by legal systems.

Legal Ownership

The formal and legally recognized possession of property, rights, or interests, backed by law.

True Value

Represents the actual, inherent worth of an asset, free from market fluctuations or perceptions.

Q38: Tennis Pro, a Virginia Corporation domiciled in

Q43: B-Line Company reported pretax net income from

Q45: Alhambra Corporation, a U.S. corporation, receives a

Q47: Entities classify all deferred tax assets and

Q67: Christian transferred $60,000 to an irrevocable trust

Q73: Which of the following is a true

Q76: Amy is a U.S. citizen. During the

Q81: Studios reported a net capital loss of

Q87: Boca Corporation, a U.S. corporation, received a

Q115: Life insurance is an asset that can