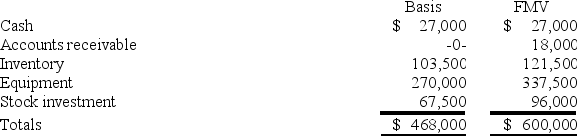

Zayde is a 1/3 partner in the ARZ partnership with an outside basis of $156,000 on January 1. Zayde sells his partnership interest to Thomas on January 1st for $180,000 cash. The ARZ Partnership has the following assets and no liabilities as of January 1:

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased 3 years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

The equipment was purchased for $360,000 and the partnership has taken $90,000 of depreciation. The stock was purchased 3 years ago. What is the amount and character of Zayde's gain or loss on the sale of his partnership interest?

Definitions:

Sleep Deprivation

The condition of not having enough sleep, which can impair cognitive function, mood, and physical health.

Serotonin

A chemical messenger vital for regulating mood, digestion, sleep, and various bodily activities.

Suprachiasmatic Nucleus

A tiny region in the brain's hypothalamus responsible for controlling circadian rhythms, functioning as the body's internal clock.

Sleep Cycles

The progression through various stages of sleep, including REM and non-REM phases, which repeat approximately every 90 minutes.

Q5: State tax law is comprised solely of

Q7: S corporations are not entitled to a

Q39: Gain and loss realized in a section

Q46: Provo Corporation, a U.S. corporation, received a

Q65: In general, a temporary difference reflects a

Q68: Stock distributions are always tax-free to the

Q79: On March 15, 2018, J. D. sold

Q104: Which of the following does not adjust

Q120: An S corporation shareholder calculates his initial

Q129: Clampett, Inc. has been an S corporation