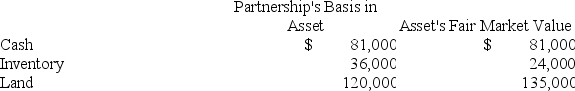

Doris owns a 1/3 capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris' gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Categorical

Refers to a type of data that can be divided into groups or categories that are mutually exclusive.

Variable

An element, feature, or factor that is liable to vary or change, the values of which can differ in a dataset or experiment.

Key Characteristic

An attribute or feature that is deemed essential or significantly important.

Variables

Elements or quantities that can vary or change in a study or experiment.

Q17: Which of the following is not an

Q18: Which of the following statements is true?<br>A)

Q36: Daniela is a 25% partner in the

Q47: Portland Corporation is a U.S. corporation engaged

Q53: A distribution in partial liquidation of a

Q61: Which of the following statements is true?<br>A)

Q62: Riley is a 50% partner in the

Q66: Which of the following S corporations would

Q78: A U.S. corporation reports its foreign tax

Q93: Gordon operates the Tennis Pro Shop in