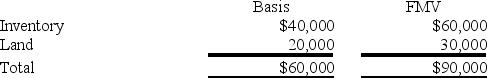

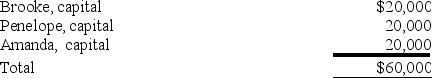

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Definitions:

DSL

Digital Subscriber Line, a family of technologies that provide internet access by transmitting digital data over the wires of a local telephone network.

56K Modem

A type of modem used for dial-up internet access, allowing data transmission speeds up to 56 kilobits per second.

Mechanical

Pertaining to the design, operation, or working of machines or machinery; involving moving parts or systems.

Q5: State tax law is comprised solely of

Q8: Adrian owns two parcels of real estate.

Q10: Which of the following statements best describes

Q12: Otter Corporation reported taxable income of $400,000

Q31: A corporation may carry a net capital

Q51: In December 2017, Jill incurred a $50,000

Q64: Marty is a 40% owner of MB

Q85: Suppose Clampett, Inc. terminated its S election

Q88: A taxpayer must receive voting common stock

Q96: Which of the following statements regarding a