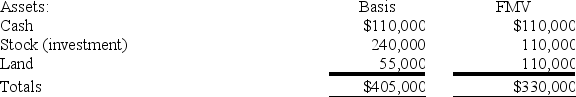

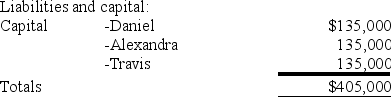

Daniel's basis in the DAT Partnership is $135,000. DAT distributes its land to Daniel in complete liquidation of his partnership interest. DAT reports the following balance sheet just before the distribution:

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

If DAT has a §754 election in place, what is the amount and sign (positive or negative) of the special basis adjustment resulting from the distribution to Daniel? What is DAT's basis in its remaining assets?

Definitions:

Agricultural Fertility

The capacity of land to produce abundant crop yields, often influenced by soil quality, climate, water availability, and agricultural practices.

Lightning

A natural electrical discharge of very short duration and high voltage between a cloud and the ground or within a cloud.

Mexica

Indigenous people of the Valley of Mexico, best known as the ruling ethnic group of the Aztec Empire, renowned for their complex society, architecture, and contributions to agriculture.

Aztecs

A Mesoamerican culture that flourished in central Mexico in the 14th to 16th centuries, known for their complex social structure, achievements in art and architecture, and conquered by the Spanish in 1521.

Q2: Continuity of interest as it relates to

Q7: Locke is a 50% partner in the

Q20: Which of the following statements regarding hot

Q34: DeWitt Corporation reported pretax book income of

Q37: Sue and Andrew form SA general partnership.

Q40: For partnership tax years ending after December

Q55: Congress reduced the corporate tax rate from

Q62: The main difference between a partner's tax

Q66: What is the correct order for applying

Q84: For a corporation, goodwill created in an