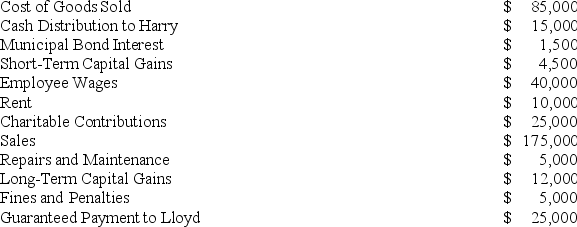

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Definitions:

Review And Reconciliation

The process of verifying the accuracy of financial records by comparing two sets of data or accounts to ensure they match.

Internal Auditors

Professionals employed by an organization to perform audits on its operations, systems, and processes to ensure accuracy, compliance, and efficiency.

Shift Supervisors

Individuals responsible for overseeing operations and workers during a specific period or shift within a workplace.

Segregation Of Duties

An internal control measure that divides responsibilities among different people to reduce risk of error or fraud.

Q6: Big Company and Little Company are both

Q14: Unincorporated entities are typically treated as flow-through

Q18: Appleton Corporation, a U.S. corporation, reported total

Q32: Federico is a 30% partner in the

Q36: Gerald received a one-third capital and profit

Q64: Under a U.S. treaty, what must a

Q66: Public Law 86-272 protects only companies selling

Q84: Boca Corporation, a U.S. corporation, reported U.S.

Q92: A corporation undertakes a valuation allowance analysis

Q93: Which of the following would not be