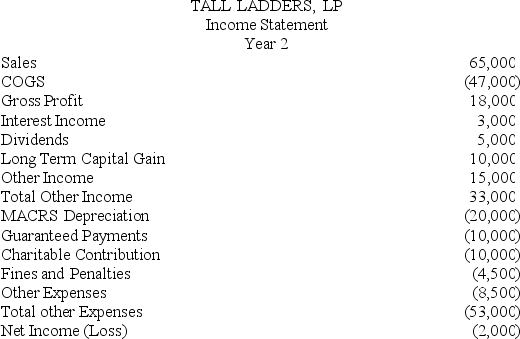

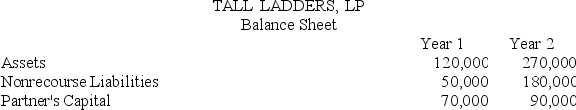

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following Income Statement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Mundane Time

The everyday experience of time, marked by routine activities and ordinary moments, as opposed to extraordinary or significant events.

Premarital Relationships

Relationships between individuals who are engaged in a romantic connection but are not yet married.

Level Of Satisfaction

The degree to which one's expectations, desires, and needs are fulfilled or surpassed.

Expectation For Marriage

entails the beliefs and presumptions individuals have about marriage, including roles, responsibilities, and emotional connections, impacting marital satisfaction and longevity.

Q5: A calendar-year corporation has positive current E&P

Q10: Fred has a 45% profits interest and

Q11: Evergreen Corporation distributes land with a fair

Q18: General Inertia Corporation made a distribution of

Q28: Public Law 86-272 protects certain business activities

Q49: A §754 election is made by a

Q51: What document must LLCs file with the

Q56: Jason is a 25% partner in the

Q59: Robinson Company had a net deferred tax

Q97: Large corporations (corporations with more than $1,000,000