Alfred, a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for years 1 and 2.

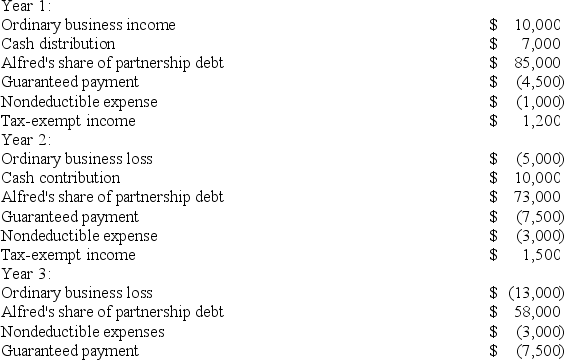

Using the following information from Alfred's year 1, year 2, and year 3 Schedule K-1, calculate his tax basis the end of year 2 and year 3.

Definitions:

Inequality

The state of not being equal, especially in status, rights, and opportunities.

Denial

A defense mechanism in which confrontation with a reality or fact is avoided by denying the existence of the problem or reality itself.

Genocide

The deliberate killing of a large group of people, especially those of a particular ethnic group or nation, with the intent to destroy that group.

Lactose Tolerance

The ability of adults to digest lactose, a sugar found in milk, due to the continued production of the enzyme lactase beyond infancy.

Q21: Which of the following statements best describes

Q23: Milton Corporation reported pretax book income of

Q28: Tim, a real estate investor, Ken, a

Q38: Wonder Corporation declared a common stock distribution

Q40: Many states are either starting to or

Q53: Which of the following statements best describes

Q79: Marlin Corporation reported pretax book income of

Q92: PWD Incorporated is an Illinois corporation. It

Q100: At the end of last year, Cynthia,

Q122: Which of the following is not considered