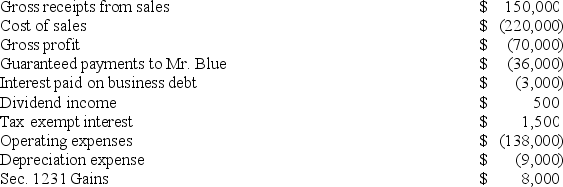

On January 1, 20X9, Mr. Blue and Mr. Grey each contributed $100,000 to form the B&G general partnership. Their partnership agreement states that they will each receive a 50% profits and loss interest. The partnership agreement also provides that Mr. Blue will receive an annual $36,000 guaranteed payment. B&G began business on January 1, 20X9. For its first taxable year, its accounting records contained the following information:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

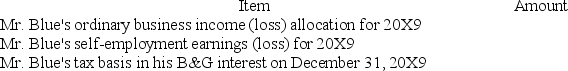

Complete the following table related to Mr. Blue's interest in B&G partnership:

Definitions:

Executed Agreement

A contract that has been fully performed by all parties involved, with all terms satisfied and obligations met.

Essential Terms

The main conditions or stipulations that are crucial to the validity and execution of a contract or agreement.

Intention

An element of a valid contract; the parties must objectively intend for an agreement to be legally binding.

Reasonable Person

A hypothetical individual in the legal system who exercises average care, skill, and judgment in conduct and is used as a comparative standard for negligence.

Q6: The focus of ASC 740 is the

Q10: For tax purposes, a corporation may deduct

Q26: A gross receipts tax is subject to

Q41: Paladin Corporation transferred its 90 percent interest

Q51: Cheyenne Corporation is a U.S. corporation engaged

Q65: In general, a temporary difference reflects a

Q70: The Emerging Issues Task Force assists the

Q77: Swordfish Corporation reported pretax book income of

Q80: Which of the following legal entities file

Q89: Siblings are considered "family" under the stock