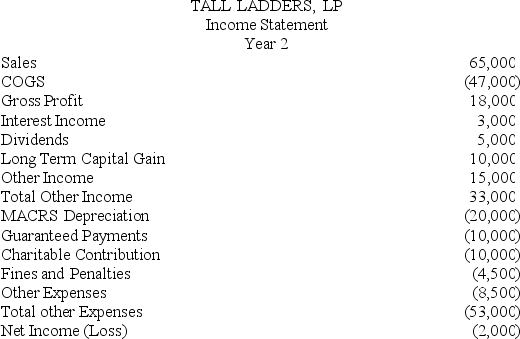

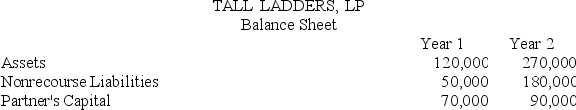

At the end of year 1, Tony had a tax basis of $40,000 in Tall Ladders, Limited Partnership. Tony has a 20 percent profits interest in Tall Ladders. For year 2, Tall Ladders will pay Tony a $10,000 guaranteed payment for extra services he provides to the partnership. Given the following Income Statement and Balance Sheet from Tall Ladders, what is Tony's adjusted tax basis at the end of year 2?

Definitions:

Property Tax

A levy on property that the owner is required to pay, usually based on the value of the property.

Benjamin Franklin

An American polymath who was a founding father of the United States.

Certain

Completely confident or sure about a situation or outcome.

Taxes

Mandatory financial charges or some other type of levy imposed upon a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Q10: For tax purposes, a corporation may deduct

Q13: Sherburne Corporation reported current earnings and profits

Q19: Clampett, Inc. has been an S corporation

Q22: A general partner's share of ordinary business

Q37: Randolph is a 30% partner in the

Q52: Built-in gains recognized fifteen years after a

Q71: GenerUs Inc.'s board of directors approved a

Q87: Over what time period do corporations amortize

Q91: Jessica is a 25% partner in the

Q113: Public Law 86-272 was a congressional response