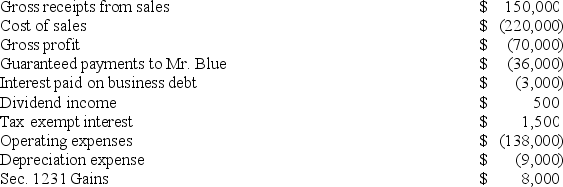

On January 1, 20X9, Mr. Blue and Mr. Grey each contributed $100,000 to form the B&G general partnership. Their partnership agreement states that they will each receive a 50% profits and loss interest. The partnership agreement also provides that Mr. Blue will receive an annual $36,000 guaranteed payment. B&G began business on January 1, 20X9. For its first taxable year, its accounting records contained the following information:

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

The $3,000 of interest was paid on a $60,000 loan made to B&G by Key Bank on June 30, 20X9. B&G repaid $10,000 of the loan on December 15, 20X9. Neither of the partners received a cash distribution from B&G in 20X9.

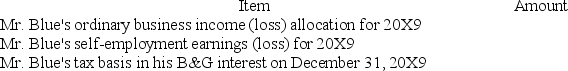

Complete the following table related to Mr. Blue's interest in B&G partnership:

Definitions:

Relaxation Techniques

Methods or practices designed to reduce tension and stress in the body, often involving breathing exercises, meditation, or physical activity.

Biofeedback

A technique that teaches individuals to control bodily processes that are normally involuntary, like heart rate, through monitoring.

Physical Health Effects

The impact on the body's condition, influenced by behaviors, genetics, and environmental factors.

Mental Health Effects

Consequences or impacts on an individual's psychological well-being and functioning.

Q22: TarHeel Corporation reported pretax book income of

Q39: If Annie and Andy (each a 30%

Q44: In what order should the tests to

Q45: Which of the following is an income

Q56: Several states are now moving from a

Q61: Rainier Corporation, a U.S. corporation, manufactures and

Q64: Comet Company is owned equally by Pat

Q80: A valuation allowance is recorded against a

Q88: A rectangle with a triangle within it

Q102: A state's apportionment formula divides nonbusiness income