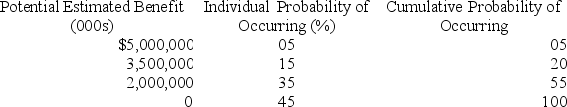

Acai Corporation determined that $5,000,000 of its R&D credit on its current year tax return was uncertain. Acai determined that there was a 40 percent chance of the credit being sustained on audit. Management made the following assessment of the company's potential tax benefit from the R&D credit and its probability of occurring.

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Definitions:

Weight Distribution

The way in which weight is spread across an object or surface, affecting its balance and stability.

High Calorie

Foods or substances that are dense in calories, often containing a high level of fats, sugars, or both.

Hypothalamus

A region of the brain responsible for the regulation of certain metabolic processes and other activities of the autonomic nervous system, including temperature control, hunger, and thirst.

Obesity Model

A conceptual framework used to understand the causes, effects, and treatments of obesity.

Q8: The employee's income for restricted stock is

Q15: Jazz Corporation owns 50% of the Williams

Q26: Which of these items is not an

Q37: On July 1 of year 1, Elaine

Q39: LLC members have more flexibility than corporate

Q45: Defined benefit plans specify the amount of

Q46: Unincorporated entities with only one individual owner

Q60: The C corporation tax rate is significantly

Q60: NOL and capital loss carryovers are deductible

Q77: The character of each separately stated item