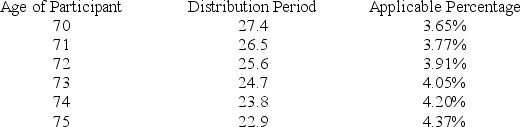

Sean (age 74 at end of 2018) retired five years ago. The balance in his 401(k) account on December 31, 2017 was $1,700,000 and the balance in his account on December 31, 2018 was $1,750,000. In 2018, Sean received a distribution of $50,000 from his 401(k) account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the IRS table below in determining the minimum distribution penalty, if any).

Definitions:

Deferred Contribution

Refers to contributions or payments that are postponed to a future date rather than being made immediately.

Net Assets

The total assets of a company or organization minus its total liabilities; an indicator of financial health.

Investment Income

Income generated from the allocation of funds into financial assets or properties expecting to gain profits.

Purchasing Power

The worth of a currency reflected by the quantity of goods or services a single unit of that currency can purchase.

Q7: Which of the following taxes would not

Q23: Employees complete a Form W-2 to specify

Q25: In its first year of existence, BYC

Q25: In certain circumstances, a taxpayer who does

Q56: Which of the following is not a

Q61: Corporations are not allowed to deduct charitable

Q66: A taxpayer who rents out a home

Q80: Employers cannot discriminate between highly and non-highly

Q101: Taylor LLC purchased an automobile for $55,000

Q104: Which of the following statements is true