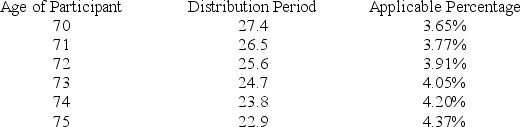

Sean (age 74 at end of 2018) retired five years ago. The balance in his 401(k) account on December 31, 2017 was $1,700,000 and the balance in his account on December 31, 2018 was $1,750,000. In 2018, Sean received a distribution of $50,000 from his 401(k) account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the IRS table below in determining the minimum distribution penalty, if any).

Definitions:

Price Elasticity

A measure of how much the quantity demanded of a good responds to a change in the price of that good, often influencing pricing strategies.

Demand Curve

A graphical representation of the relationship between the price of a good and the quantity demanded by consumers.

Infinity

A concept in mathematics and physics that refers to a quantity without bound or end.

Unit Elastic

A situation where a percentage change in the price of a good causes an equal percentage change in the quantity demanded or supplied.

Q5: Riley participates in his employer's 401(k) plan.

Q12: Shauna received a $100,000 distribution from her

Q28: Net operating losses generally create permanent book-tax

Q52: Which of the following types of expenditures

Q59: Luke sold land valued at $210,000. His

Q63: Depending on the year, the original (unextended)

Q79: Which of the following statements regarding the

Q82: Temporary differences create either a deferred tax

Q96: Heidi (single) purchased a home on January

Q140: The American opportunity credit is available only