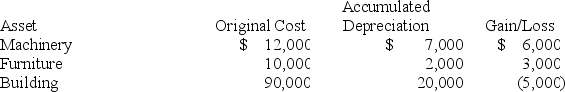

Andrew, an individual, began business four years ago and has never sold a §1231 asset. Andrew owned each of the assets for several years. In the current year, Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Aesthetic Person

An individual who has a deep appreciation for beauty, art, and tastefulness in various aspects of life.

Cognitive Approach

is a psychological perspective that emphasizes the importance of mental processes in how people perceive, remember, think, and solve problems.

Personal Relations

The interactions and bonds between individuals, often referring to relationships of a non-professional nature.

Ethical Climates

The collective perception of what is morally right or wrong within an organization, influencing ethical decision-making and behavior.

Q8: An installment sale is any sale where

Q9: Deductible medical expenses include payments to medical

Q11: What is the underpayment penalty rate that

Q24: Michelle is an active participant in the

Q26: Which of the following is a true

Q28: In the current year, Norris, an individual,

Q35: Jasmine started a new business in the

Q49: Mercury is self-employed and she uses a

Q56: All business expense deductions are claimed as

Q100: Kimberly's employer provides her with a personal