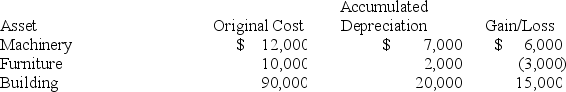

Suzanne, an individual, began business four years ago and has never sold a §1231 asset. Suzanne owned each of the assets for several years. In the current year, Suzanne sold the following business assets:

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Definitions:

Workers' Compensation System

A statutory framework designed to provide financial compensation, medical care, and benefits to employees who suffer job-related injuries or illnesses.

Unconstitutional

A law or action is deemed unconstitutional if it violates the principles or stipulations of the Constitution.

Public Employees

Individuals employed by government entities at the federal, state, or local level, including civil servants and public sector workers.

Public Policy Exception

A legal principle allowing courts to refuse to enforce certain contracts or clauses if they are in violation of the established public policy of the state or country.

Q10: The gain or loss realized on the

Q10: Employees may exclude from income items such

Q12: Crouch LLC placed in service on May

Q19: When electing to include preferentially-taxed capital gains

Q32: Taxpayers renting a home would generally report

Q58: Which of the following legal entities are

Q65: Katrina's executive compensation package allows her to

Q66: In its first year of existence (2018)

Q78: Baker is single and earned $225,000 of

Q106: Which of the following best describes distributions