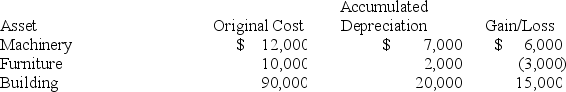

Suzanne, an individual, began business four years ago and has never sold a §1231 asset. Suzanne owned each of the assets for several years. In the current year, Suzanne sold the following business assets:

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Definitions:

Canadian Dollar

The currency of Canada, represented by the ISO code "CAD" and symbolized by "$".

U.S. Dollar

The official currency of the United States and a standard unit of measurement for global financial transactions.

Triangle Arbitrage

A riskless profit strategy that takes advantage of discrepancies in exchange rates in different markets by conducting a series of conversions among three currencies.

Currency Market

Also known as the foreign exchange market (Forex), it's a decentralized global market where currencies are traded, determining the foreign exchange rates for every currency.

Q1: Kenneth lived in his home for the

Q8: Which of the following statements describes how

Q34: Paul and Melissa plan on filing jointly

Q45: All taxpayers must account for taxable income

Q54: Which of the following is not a

Q63: Which of the following benefits cannot be

Q79: Gabby operates a pizza delivery service. This

Q91: Flexible spending accounts allow employees to set

Q104: Taxpayers can recognize a taxable gain on

Q115: Tyson (48 years old) owns a traditional