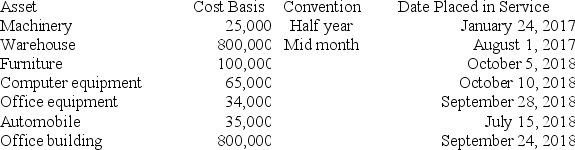

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2017 and 2018:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017, but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2018. (Use MACRS Table 1, Table 5 and Exhibit 10-10 ) (Round final answer to the nearest whole number.)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017, but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2018. (Use MACRS Table 1, Table 5 and Exhibit 10-10 ) (Round final answer to the nearest whole number.)

Definitions:

Economic Forces

Economic factors facing Canadian business today, including global trade forces and the force to increase one’s own competitiveness and productivity levels.

Global Trade

The exchange of goods, services, and capital across international borders, influenced by global economic policies and agreements.

Service Industries

Sectors of the economy that provide intangible goods or services to consumers, such as healthcare, banking, and education.

Extractive Industries

Industries, such as mining, oil drilling, and logging, that remove natural resources from the earth, often with significant environmental impact.

Q7: Pyrrha, a 12-year-old dependent of Epimetheus and

Q32: When the wash sale rules apply, the

Q38: Amit purchased two assets during the current

Q41: When applying credits against a taxpayer's gross

Q48: Ralph borrowed $4 million and used the

Q51: Employers computing taxable income receive a deduction

Q79: Leesburg sold a machine for $2,200 on

Q89: Michael (single) purchased his home on July

Q96: Suzanne received 20 ISOs (each option gives

Q115: Tyson (48 years old) owns a traditional