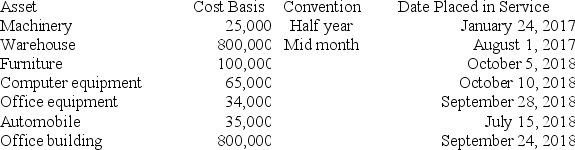

Boxer LLC has acquired various types of assets recently used 100% in its trade or business. Below is a list of assets acquired during 2017 and 2018:

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017, but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2018. (Use MACRS Table 1, Table 5 and Exhibit 10-10 ) (Round final answer to the nearest whole number.)

Boxer did not elect §179 expense and elected out of bonus depreciation in 2017, but would like to take advantage of the §179 expense and bonus depreciation for 2018 (assume that taxable income is sufficient). Calculate Boxer's maximum depreciation expense for 2018. (Use MACRS Table 1, Table 5 and Exhibit 10-10 ) (Round final answer to the nearest whole number.)

Definitions:

Expiratory Phase

The part of the respiratory cycle where air is expelled from the lungs.

Pale Nasal Mucosa

A condition where the lining of the nose appears lighter in color, which can be a sign of dehydration or other medical conditions.

Clubbing

Bulging of the tissues at the nail base caused by insufficient oxygenation at the periphery, resulting from conditions such as chronic emphysema and congenital heart disease.

Allergies

Hypersensitivity reactions of the immune system to certain substances which are harmless for most people.

Q9: For a like-kind exchange, realized gain is

Q30: Which of the following statements concerning traditional

Q31: Explain whether the sale of a machine

Q36: Which of the following is a true

Q53: What is the maximum amount of gain

Q55: What is the tax treatment for qualified

Q59: Which of the following is a true

Q71: The medical expense deduction is designed to

Q97: Dick pays insurance premiums for his employees.

Q102: All tax gains and losses are ultimately