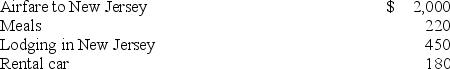

Shelley is employed in Texas and recently attended a two-day business conference at the request of her employer. Shelley spent the entire time at the conference and documented her expenditures (described below) . What amount can Shelley deduct if she is not reimbursed by her employer?

Definitions:

Enforced

Compelled or mandated action or compliance, often through legal or authoritative measures.

Antitrust Laws

Legislation intended to promote competition and prevent monopolies by regulating anti-competitive practices.

Historical Background

The historical context or past events leading to the current state or understanding of a subject, providing insight into its development and changes over time.

Regulation

The act of controlling, governing, or managing activities, especially through rules and standards set by authorities or bodies.

Q6: Kaylee is a self-employed investment counselor who

Q15: Which of the following is a fringe

Q29: Which of the following is not usually

Q34: Hazel received 20 NQOs (each option gives

Q40: Ethan competed in the annual Austin Marathon

Q74: Boot is not like-kind property involved in

Q87: Margaret Lindley paid $15,000 of interest on

Q94: Assume Georgianne underpaid her estimated tax liability

Q115: Gambling winnings are included in gross income

Q141: Which of the following statements concerning tax