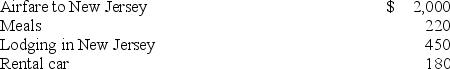

Shelley is employed in Texas and recently attended a two-day business conference at the request of her employer. Shelley spent the entire time at the conference and documented her expenditures (described below) . What amount can Shelley deduct if she is not reimbursed by her employer?

Definitions:

Offer Agreement

A detailed proposal by one party to enter into a contract, subject to acceptance by another party.

Adhesion Contract

A standardized contract prepared by one party, with little to no negotiation allowed, often in situations with unequal bargaining power.

Definite Offer

An offer that is clear, specific, and leaves no room for negotiation, often containing all the terms necessary for an enforceable agreement.

Definite Acceptance

Definite Acceptance refers to an unambiguous agreement by the offeree to meet the terms of the offer, forming a binding contract.

Q3: Heidi, age 45, has contributed $20,000 in

Q10: A business generally adopts a fiscal or

Q16: Andrew Whiting (single) purchased a home in

Q48: Identify the rule dictating that on a

Q54: Henry, a single taxpayer with a marginal

Q64: Timothy purchased a new computer for his

Q78: Which of the following is true regarding

Q98: Bonnie Jo purchased a used camera (5-year

Q101: Kathy is 60 years of age and

Q127: Which of the following is not one