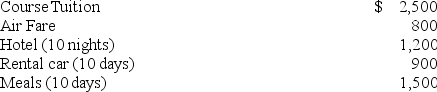

Sam operates a small chain of pizza outlets in Fort Collins, Colorado. In November of this year Sam decided to attend a two-day management training course. Sam could choose to attend the course in Denver or Los Angeles. Sam decided to attend the course in Los Angeles and take an eight-day vacation immediately after the course. Sam reported the following expenditures from the trip:

What amount of travel expenditures can Sam deduct?

What amount of travel expenditures can Sam deduct?

Definitions:

Miles Per Gallon

A measure of fuel efficiency in vehicles, representing the number of miles a vehicle can travel per gallon of fuel.

Degrees of Freedom

The number of independent pieces of information available to estimate another piece of information or the parameters of a model.

Treatments

The conditions or interventions applied to participants in an experimental study.

F-Test

An F-test is a type of statistical test that compares the variances of two populations to determine if they are significantly different from each other.

Q2: Which of the following statements regarding Roth

Q49: Parents may claim a child and dependent

Q50: Manley operates a law practice on the

Q59: Lisa, age 45, needed some cash so

Q61: Maren received 10 NQOs (each option gives

Q68: Max, a single taxpayer, has a $270,000

Q70: Judy is a self-employed musician who performs

Q70: Ashburn reported a $105,000 net §1231 gain

Q76: Taxpayers who participate in an employer-sponsored retirement

Q103: Like financial accounting, most acquired business property