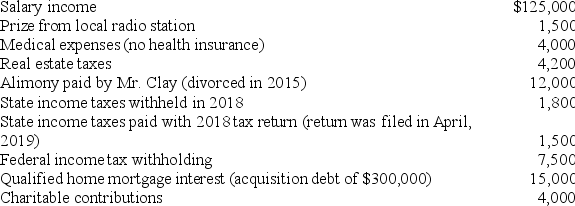

During all of 2018, Mr. and Mrs. Clay lived with their four children (all are under the age of 17). They provided over one-half of the support for each child. Mr. and Mrs. Clay file jointly for 2018. Neither is blind, and both are under age 65. They reported the following tax-related information for the year: (Use the tax rate schedules)

A. What is the Clays' taxes payable or (refund due) (ignore the alternative minimum tax)?

A. What is the Clays' taxes payable or (refund due) (ignore the alternative minimum tax)?

B. What is the Clays' tentative minimum tax and alternative minimum tax?

Definitions:

Google Wallet

A digital payment service developed by Google that allows users to store and use various forms of payment.

Tencent

A major Chinese technology and entertainment conglomerate known for its social messaging app WeChat and its vast portfolio of video games and online services.

Cellular Technologies

Technologies for mobile communication that enable the transmission of voice and data over a network of geographically divided cells from a mobile device to a cell site.

GasBuddy

GasBuddy is a mobile application that helps users find nearby gas stations with the cheapest prices and provides other services such as reviews and amenities.

Q5: A taxpayer instructing her son to collect

Q9: Worker's compensation benefits are excluded from gross

Q25: Even a cash method taxpayer must consistently

Q27: The standard deduction amount varies by filing

Q28: In the current year, Norris, an individual,

Q34: Scott is a self-employed plumber and his

Q50: Ordinary gains and losses are obtained on

Q54: If Nicolai earns an 8% after-tax rate

Q69: In June of year 1, Eric's wife

Q111: In 2018, Maia (who files as a