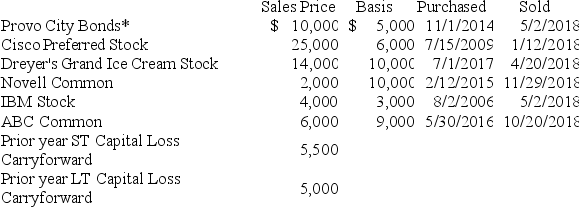

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City

*Purchased when originally issued by Provo City

What is the Net Short-Term Capital Gain/Loss reported on the 2018 Schedule D? What is the Net Long-Term Capital Gain/Loss reported on the 2018 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Definitions:

Revenues

The total income generated from normal business operations and other activities before any expenses are subtracted.

Balance Sheet

A financial statement that shows a company's assets, liabilities, and shareholders' equity at a specific point in time.

Liabilities

Financial obligations or debts owed by a business to outsiders, such as loans, accounts payable, or bonds.

Owner's Equity

The owner's residual interest in the assets of the business after deducting liabilities, representing ownership value in a company.

Q10: Jenna (age 50) files single and reports

Q23: Miley, a single taxpayer, plans on reporting

Q43: Chuck has AGI of $70,000 and has

Q59: Columbia LLC only purchased one asset this

Q68: Qualified fringe benefits received by an employee

Q80: Misha traded computer equipment used in her

Q93: Arlington LLC exchanged land used in its

Q98: Bernie is a former executive who is

Q108: Which of the following is not true

Q123: Lydia and John Wickham filed jointly in