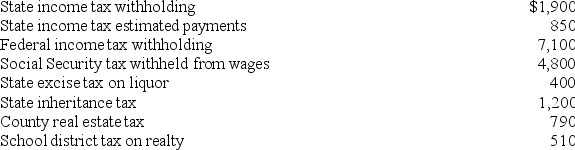

Chuck has AGI of $70,000 and has made the following payments

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Calculate the amount of taxes that Chuck can include with his itemized deductions.

Definitions:

Manufacturing Overhead

Manufacturing overhead includes all manufacturing costs other than direct materials and direct labor, such as rent, utilities, and depreciation on manufacturing facilities.

Predetermined Overhead Rate

A rate calculated at the beginning of an accounting period to allocate overhead costs to products or services based on a relevant activity base.

Variable Manufacturing Overhead

Costs that vary with the level of production output and may include items such as utility expenses and raw materials.

Direct Labor-Hours

Total time spent by staff members who are directly part of the manufacturing operations.

Q8: Anne LLC purchased computer equipment (5-year property)

Q10: A taxpayer paying his 10-year-old daughter $50,000

Q14: Investment interest expense is a for AGI

Q17: Which of the following types of interest

Q46: Sairra, LLC purchased only one asset during

Q51: Which of the following is likely to

Q73: Which of the following has the highest

Q98: Assume that Lavonia's marginal tax rate is

Q109: Which of the following statements regarding the

Q116: For taxpayers who receive both salary as