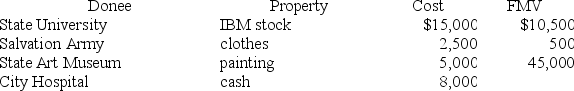

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitable purpose.

Definitions:

Total Costs

The complete sum of all expenses, both fixed and variable, incurred in the production of goods or services.

Break-even Quantity

The number of units that must be sold to cover all costs, after which profit begins to be generated.

Advertising Expenses

Costs incurred in promoting a product, service, or brand through various media, including print, online, television, and outdoor advertising.

Contribution Margin

The amount of revenue from sales that exceeds variable costs, providing a measure of the ability of a company to cover its fixed costs and contribute to profit.

Q4: In January of the current year, Dora

Q6: An office building was purchased on December

Q27: Beth's business purchased only one asset during

Q45: Long-term capital gains (depending on type) for

Q50: The investment interest expense deduction is limited

Q54: Taxpayers are allowed to deduct mortgage interest

Q68: Which of the following tax credits is

Q91: Which of the following statements regarding for

Q109: Rhett made his annual gambling trip to

Q110: In general, a CPA will satisfy his