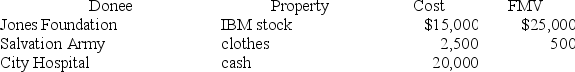

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting has been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting has been owned for 10 years.

Definitions:

Reliability

The degree to which an assessment tool or measurement produces stable and consistent results.

Numerical Index

A system of assigning numbers to objects, individuals, or events for the purpose of identification, classification, or comparison.

Test

An assessment intended to measure the knowledge, skill, aptitude, physical fitness, or classification in many other topics.

Abstract

A brief summary of a research article, thesis, review, or other document, highlighting the main points and conclusions.

Q13: Mason paid $4,100 of interest on a

Q31: For the following tax returns, identify the

Q33: Assume that Shavonne's marginal tax rate is

Q45: Long-term capital gains (depending on type) for

Q67: Which of the following is a true

Q70: Aubrey and Justin file married filing separately.

Q77: The goal of tax planning generally is

Q86: Jorge purchased a copyright for use in

Q97: Compare and contrast the constructive receipt doctrine

Q110: Rental income generated by a partnership is