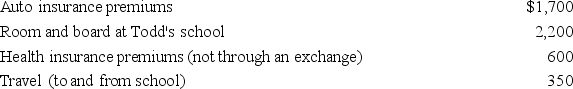

Ned is a head of household with a dependent son, Todd, who is a full-time student. This year Ned made the following expenditures related to Todd's support:  What amount can Ned include in his itemized deductions?

What amount can Ned include in his itemized deductions?

Definitions:

Overhead Applied

The portion of indirect costs allocated to a specific product or department within a company, based on a predetermined overhead rate.

Cost of Goods Sold

The immediate expenses linked to the creation of products sold by a business, encompassing both materials and labor costs.

Job Costing

A cost accounting method used to track costs to a specific job or project, allowing companies to calculate its profitability.

Process Costing

A costing methodology used in manufacturing where costs are allocated to products based on the processes they go through.

Q6: Tax rate schedules are provided for use

Q11: What is the underpayment penalty rate that

Q23: Simon was awarded a scholarship to attend

Q56: Which of the following is not a

Q58: For married couples, the Social Security wage

Q69: Taffy Products uses the accrual method and

Q75: Which of the following decreases the benefits

Q82: Santa Fe purchased the rights to extract

Q90: How is the recovery period of an

Q124: An individual with gross income of $5,000