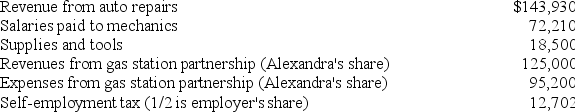

Alexandra operates a garage as a sole proprietorship. Alexandra also owns a half interest in a partnership that operates a gas station. This year Alexandra paid or reported the following expenses related to her garage and other property. Determine Alexandra's AGI for 2018.

Definitions:

F Statistic

A value calculated in the ANOVA test to determine if the means between two or more groups are significantly different.

Null Hypothesis

A statement or assumption that indicates no effect or no difference, which the statistical test aims to reject.

Interaction

In statistics and research, it refers to a situation where the effect of one independent variable on the dependent variable differs depending on the level of another independent variable.

Profile Plot

A graphical representation of the multivariate data where each observation is represented by a plot, often used to observe patterns over time or conditions.

Q2: Flax, LLC purchased only one asset this

Q4: Clay LLC placed in service machinery and

Q19: Under the tax law, taxpayers may be

Q23: Which of the following is a deductible

Q32: Claire donated 200 publicly-traded shares of stock

Q37: The deduction for medical expenses is limited

Q37: Deirdre's business purchased two assets during the

Q50: In February of 2017, Lorna and Kirk

Q122: Loretta received $6,200 from a disability insurance

Q143: Akiko and Hitachi (married filing jointly for