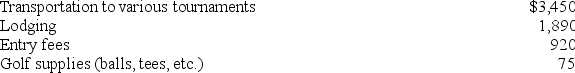

Detmer is a successful doctor who earned $204,800 in fees this year, but he also competes in weekend golf tournaments. Detmer reported the following expenses associated with competing in almost a dozen tournaments:

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

This year Detmer won $5,200 from competing in various golf tournaments. Assuming that Detmer itemizes his deductions and that he did not have any other miscellaneous itemized deductions, what amount of the golfing expenses are deductible after considering all limitations if the tournament golfing is treated as a hobby activity?

Definitions:

Task System

A labor system used on plantations, particularly in the cultivation of rice and cotton, where enslaved people were assigned specific tasks to complete each day, as opposed to working from sunrise to sunset.

Slave

A person who is the legal property of another and is forced to obey them.

Quota

A fixed share or allocation of something, often applied to trade limitations, immigration controls, or production targets.

Dahomey

A historical kingdom in West Africa, known for its powerful military, wealth through trade, and role in the transatlantic slave trade.

Q15: Danny argues that tax accountants suffer from

Q33: Brandon and Jane Forte file a joint

Q34: The IRS would most likely apply the

Q41: The Internal Revenue Code authorizes deductions for

Q41: Kerri, a single taxpayer who itemizes deductions

Q43: The timing strategy becomes more attractive if

Q59: Rowanda could not settle her tax dispute

Q70: The alternative depreciation system requires both a

Q100: This year Mary received a $200 refund

Q126: Jackson earned a salary of $254,000 in