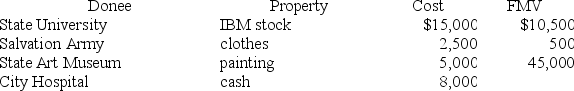

This year Darcy made the following charitable contributions:

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitable purpose.

Determine the maximum amount of charitable deduction for Darcy's contribution of the painting if her AGI is $80,000 this year. You may assume that both the stock and painting have been owned for 10 years and that the painting was used by the State Art Museum consistent with museum's charitable purpose.

Definitions:

External Users

Individuals or entities outside of a company who use its financial statements for decision-making, such as investors, creditors, and regulatory agencies.

Ethical Behavior

Conduct that is consistent with what society, businesses, and individuals typically think are good values.

Fundamental Business

Refers to the basic concepts, principles, and practices that form the foundation of a company's operations and strategic objectives.

Financial Information

Data related to the financial performance and financial position of an entity, including income statements, balance sheets, and cash flow statements.

Q26: Assume that Will's marginal tax rate is

Q29: Rhianna and Jay are married filing jointly

Q32: Claire donated 200 publicly-traded shares of stock

Q46: Sairra, LLC purchased only one asset during

Q65: This year Amanda paid $749 in Federal

Q67: Assume that Keisha's marginal tax rate is

Q74: The business purpose, step-transaction, and substance-over-form doctrines

Q91: To qualify as a charitable deduction the

Q110: Rental income generated by a partnership is

Q130: This year Henry realized a gain on