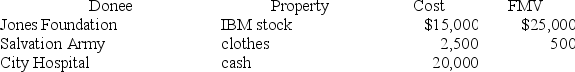

This year Latrell made the following charitable contributions:

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting has been owned for 10 years.

Determine the maximum amount of Latrell's charitable deduction assuming the Jones Foundation is a private nonoperating foundation and Latrell's AGI is $100,000 this year. You may assume that the stock and painting has been owned for 10 years.

Definitions:

Q8: Which of the following cannot be selected

Q34: Roy, a resident of Michigan, owns 25

Q40: The timing strategy is particularly effective for

Q44: On the sale of a passive activity,

Q59: If Joel earns a 10% after-tax rate

Q71: The medical expense deduction is designed to

Q81: Which of the following is a true

Q82: To determine filing status, a taxpayer's marital

Q86: Jorge purchased a copyright for use in

Q101: The child and dependent care credit entitles