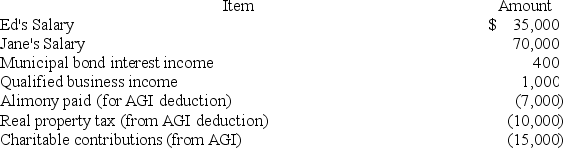

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's adjusted gross income?

Definitions:

Net Operating Income

The profit realized from a business's operations after subtracting operating expenses from operating revenues.

Break-even

The point at which total revenues equal total costs, resulting in no net profit or loss for the business.

Divisional Segment Margin

The amount of profit or loss generated by a specific division or segment of a company, often used to assess the segment's financial performance.

Common Fixed Expenses

Expenses that do not change in total amount with changes in the volume of production or sales, such as rent, salaries, and insurance.

Q12: Chris and Chuck were recently debating whether

Q14: Wendell is an executive with CFO Tires.

Q35: The _ ice shelf is the largest

Q57: Marc, a single taxpayer, earns $60,000 in

Q71: Emily is a cash basis taxpayer, and

Q71: Transpiration is the change of water vapor

Q90: Property taxes may be imposed on both

Q104: Blake is a limited partner in Kling-On

Q104: An astute tax student once summarized that

Q110: Earth's "world ocean" contains _ cubic kilometers