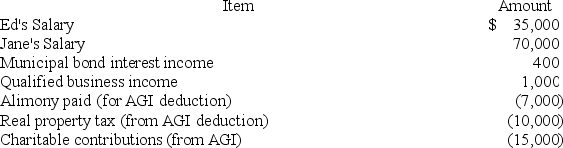

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's taxable income?

Definitions:

Chordates

A group of animals that have a notochord, a dorsal nerve cord, pharyngeal slits, and a post-anal tail at some point during their development.

Features Shared

Common traits or characteristics present across different species or groups, often indicating a common ancestry.

Taxonomic Groups

Categories used in the classification of organisms, arranged in a hierarchical system that ranges from broad to specific, such as kingdom, phylum, class, order, family, genus, and species.

Fossil Record

The collection of fossils, which are the preserved remains or imprints of organisms, providing historical evidence of life on Earth.

Q12: Nontax factor(s) investors should consider when choosing

Q12: Jack and Jill are married. This year

Q32: When the wash sale rules apply, the

Q34: The substitution effect:<br>A) predicts that taxpayers will

Q38: Effective tax planning requires all of these

Q65: Hera wants to reduce her income tax

Q77: The goal of tax planning generally is

Q131: Candace is claimed as a dependent on

Q143: Over three-fourths of the world's fresh water

Q153: The movement of groundwater is _.<br>A) upwards<br>B)