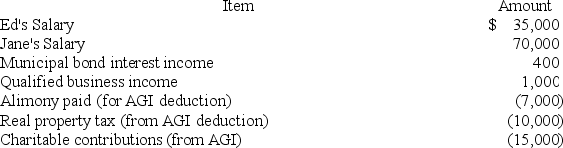

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's gross income?

Definitions:

Preschool

An educational establishment or learning environment for children typically aged between three and five years old, prior to compulsory education.

Kindergarten

A preschool educational approach traditionally based around playing, singing, practical activities, and social interaction.

Cultural Identity

The feeling of belonging to a group, community, or culture, influenced by shared traditions, beliefs, and experiences.

Bilingualism

The ability of an individual to use and understand two languages proficiently.

Q11: An individual who forfeits a penalty for

Q23: Which of the following increases the benefits

Q23: Which of the following statements regarding dependents

Q29: Joe Harry, a cash basis taxpayer, owes

Q57: Ms. Fresh bought 1,000 shares of Ibis

Q57: In researching a tax issue, Eric finds

Q82: Which of the following is a true

Q91: Bobby and Whitney are husband and wife

Q110: Earth's "world ocean" contains _ cubic kilometers

Q117: The cash method of accounting requires taxpayers