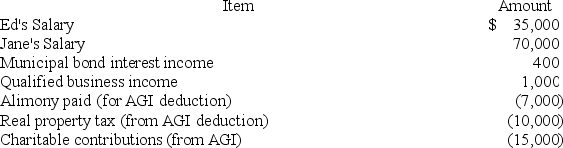

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's taxable income?

Definitions:

Locus Of Control

An individual's belief about the extent to which their actions can influence the events around them, classified as either internal (control from within oneself) or external (control by outside forces).

Learned Helplessness

A condition in which an individual learns to believe they are powerless and unable to control or change a situation, often resulting from repeated unsuccessful attempts to do so.

Planned Behavior

A theory that suggests human action is guided by behavioral intentions, which are influenced by attitudes, subjective norms, and perceived control.

Illegal Downloading

The act of obtaining files, such as music, movies, or software, from the internet without proper authorization or payment.

Q17: Taxpayers may elect to deduct state and

Q17: Paying "fabricated" expenses in high tax rate

Q29: The Great Salt Lake of Utah contains

Q55: Troy is not a very astute investor.

Q74: Harold receives a life annuity from his

Q80: The value of a tax deduction is

Q90: Nolene suspects that one of her new

Q118: Clarissa's gross tax liability for 2018 is

Q127: Most freshwater lakes have but one surface

Q130: Hera earned $175,000 salary in 2018. Her