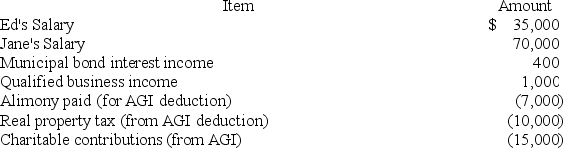

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What are the couple's taxes due or tax refund (use the tax rate schedules not tax tables)?

Definitions:

Emergent Norm

Emergent norms refer to behaviors that develop in response to a new or unusual situation, where traditional norms do not apply, and guide participants' actions within the context of that situation.

Technological Determinism

A theory of social change that assumes changes in technology drive changes in society, rather than vice versa.

Low-Carb Diet

A dietary plan that reduces carbohydrate intake in favor of proteins and fats, aimed at weight loss or health maintenance.

Paleo

Often associated with the Paleolithic diet, which is based on the presumed dietary patterns of ancient humans, emphasizing whole foods and limiting processed foods.

Q24: Michelle is an active participant in the

Q30: For each of the following, determine if

Q49: If an individual taxpayer's marginal tax rate

Q60: As a landscape feature, natural lakes should

Q61: Which of the following is not a

Q64: Unused investment interest expense:<br>A) expires after the

Q69: Mary Ann is working on a pretty

Q70: Josephine is considering taking a 6-month rotation

Q70: What is the correct order of the

Q73: Campbell, a single taxpayer, has $95,000 of