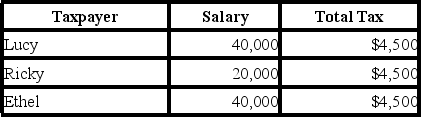

Consider the following tax rate structures. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not?

Definitions:

Straight-Line Rate

A method of calculating the depreciation of an asset, which allocates an equal depreciation expense each year over the asset's useful life.

Double Declining-Balance

A method of accelerated depreciation that doubles the straight-line depreciation rate, allowing for faster asset expense recognition.

Modified Accelerated Cost Recovery

A tax depreciation system in the U.S. that allows for the accelerated depreciation of property under certain conditions.

Longitudinal

Pertains to research or studies that collect data from the same subjects repeatedly over a period of time to observe changes and developments.

Q6: In the Northern Hemisphere, a midlatitude cyclone

Q6: The present value concept becomes more important

Q14: Joel reported a high amount of charitable

Q53: Edie would like to better understand a

Q64: The difficulty in calculating a tax is

Q67: In a proportional (flat) tax rate system,

Q72: The IRS DIF system checks each tax

Q74: The ocean's surface has a uniform distribution

Q97: Leonardo, who is married but files separately,

Q112: Temperature is usually the key difference between