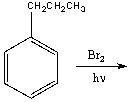

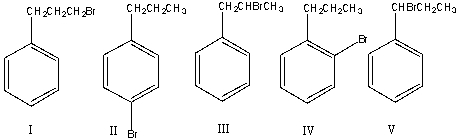

Provide the structure of the major product(s) for the following reaction.

Definitions:

Deferred Tax Asset

An item on a company’s balance sheet that represents the difference in timing between when a tax is accrued and when it is paid, potentially reducing future tax liability.

Tax Rate Change

An alteration in the percentage at which an individual or corporation is taxed, which can affect financial planning and net income.

Temporary Difference

A difference between the carrying amount of an asset or liability in the balance sheet and its tax base that will result in taxable or deductible amounts in future years.

Effective Tax Rate

The average rate at which an individual or corporation is taxed, calculated by dividing the total tax paid by the taxable income.

Q9: What is the structure for N,N-diethylaniline?

Q25: Predict the major product for the following

Q30: What is the difference between a nucleoside

Q30: Arrange the following compounds in decreasing (highest

Q31: Which one of the following represents

Q32: Predict the major product for the following

Q37: Provide the reagents necessary to carry out

Q42: What term most accurately describes the process

Q59: o-xylene is the common name for:<br>A)hydroxybenzene<br>B)aminobenzene<br>C)1,2-dimethylbenzene<br>D)ethylbenzene<br>E)1,3-dimethylbenzene

Q86: Provide the structure of the ylide needed