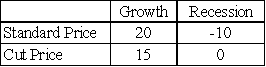

Firm X is currently selling a consumer good at a standard price,but is also considering cutting its price.The main risk facing the firm concerns the course of the economy in the near-term: whether the economy will grow at a steady pace (G)or whether it will experience a recession (R).The table below shows the firm's possible profit results (in $ millions).Finally,the firm judges that there is a 70% chance of growth and a 30% chance of a recession.

(a)Firm X must make its decision now (before knowing the future course of the economy).Which pricing policy maximizes its expected profit?

(a)Firm X must make its decision now (before knowing the future course of the economy).Which pricing policy maximizes its expected profit?

Definitions:

Fixed Resource

An asset or resource in production that cannot be easily increased or decreased in the short term, such as land or machinery.

Diminishing Returns

The principle that says as more of a variable input is added to a fixed input, the incremental gain in output will eventually decrease.

Normal Profits

The level of profit that is necessary to cover the costs of a firm, including the opportunity costs of capital, ensuring the firm remains in business.

Implicit Cost

The opportunity cost equal to what a firm must give up in order to use resources it already owns, without paying rent or purchasing them.

Q5: An oligopoly firm's effective demand curve will

Q5: The production of a good with positive

Q5: In a linear programming problem,the objective function

Q6: Explain the significance of each of the

Q13: Define uncertainty with an example.

Q18: In 2000,Amtrak,the intercity passenger train service in

Q24: Which of the following is a key

Q46: A Nash equilibrium can be defined as

Q63: Define latitude and longitude,listing the primary latitudinal

Q66: The sun radiates _ concentrated around .<br>A)longer