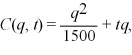

The manufacturing of paper products causes damage to a local river when the manufacturing plant produces more than 1,000 units in a period.To discourage the plant from producing more than 1,000 units,the local community is considering placing a tax on the plant.The long-run cost curve for the paper producing firm is:  where q is the number of units of paper produced and t is the per unit tax on paper production.The relevant marginal cost curve is:

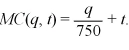

where q is the number of units of paper produced and t is the per unit tax on paper production.The relevant marginal cost curve is:  If the manufacturing plant can sell all of its output for $2,what is the firm's optimal output if the tax is set at zero? What is the minimum tax rate necessary to ensure that the firm produces no more than 1,000 units? How much are the firm's profits reduced by the presence of a tax?

If the manufacturing plant can sell all of its output for $2,what is the firm's optimal output if the tax is set at zero? What is the minimum tax rate necessary to ensure that the firm produces no more than 1,000 units? How much are the firm's profits reduced by the presence of a tax?

Definitions:

Organizational Change

The process by which companies or organizations change their structure, strategies, operational methods, technologies, or organizational culture to affect change within the organization or to respond to external influences.

Cost-Cutting Strategy

A business approach aimed at reducing expenses to improve overall profitability without compromising the quality of products or services.

Planned Organizational Change

Deliberate efforts to modify an organization's processes, culture, or structure to improve effectiveness.

Communicate

The act of conveying information, ideas, or feelings from one entity to another through various methods, including speech, writing, or non-verbal expressions.

Q6: Does it make sense to consider the

Q11: The short run is<br>A)less than a year.<br>B)three

Q17: When the average product is decreasing,marginal product<br>A)equals

Q23: The Russian government wants to reduce the

Q25: The point price elasticity of demand for

Q53: American Tire and Rubber Company sells identical

Q90: The total cost (TC)of producing computer software

Q92: Apu leases 2 squishy machines to produce

Q115: Laura's internet services has the following short-run

Q119: Compared to a tariff,an import quota,which restricts