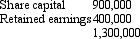

Hill Ltd acquired an 80 per cent interest in Dale Ltd on 1 July 2004 for a cash consideration of $1,200,000. At that date the shareholders' funds of Dale Ltd were:

The assets of Dale Ltd were recorded at fair value at the time of the purchase.

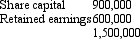

On 1 July 2005 Hill Ltd purchased the remaining 20 per cent of the issued capital of Dale Ltd for a cash consideration of $336,000. At this date the fair value of the net assets of Dale Ltd were represented by:

Impairment of goodwill amounted to $35,600; $16,000 of which related to the year ended 30 June 2006. There were no inter-company transactions. What are the consolidation entries to eliminate the investment in the subsidiary and account for goodwill for the period ended 30 June 2006?

Definitions:

Q2: Window Ltd acquired a 70 per cent

Q5: A description of the regulatory framework relevant

Q11: Which of the following statements is not

Q11: One reason for holding equity investments in

Q20: AASB 8 "Operating Segments" requires reconciliation of

Q20: AASB 131 "Interests in Joint Ventures" prescribes

Q26: Which of the following is not a

Q26: Which of the following statements is correct

Q40: An alternate director who is not acting

Q56: In accordance with AASB 8 an operating