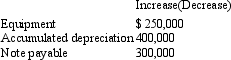

Swans Machinery Ltd reported a net profit of $3,000,000 for the year ended 30 June 2009. The following changes occurred in the balance sheet:

Additional information:

During the year Swans Ltd sold equipment with a cost of $250,000 and had accumulated depreciation of $120,000 for a gain of $50,000.

On 30 June 2009 Swans Ltd purchased equipment costing $500,000 with $200,000 in cash and a note payable for $300,000.

Depreciation expense for the year was $520,000

What is the amount of net cash from operating activities and net cash used in investing activities, respectively for the year ended 30 June 2009?

Definitions:

Outdoor Activities

Recreational or leisure activities that take place in natural settings, promoting physical health and well-being.

Video Games

Electronic games played through various devices, providing entertainment and sometimes educational content through interactive digital environments.

Epidemiological Studies

Research investigations conducted to understand the patterns, causes, and effects of health and disease conditions in defined populations.

Prevalence

The percentage of individuals in a population who are identified as having a certain condition during a particular time frame.

Q7: In considering whether to recognise revenue when

Q10: AASB 133 requires a bonus issue made

Q14: Which of the following is usually not

Q19: Issue of shares in exchange for shares

Q23: Under AASB 1023 general insurers would not

Q24: General insurance is an important part of

Q39: Pilbarra Ltd has a profit after tax

Q56: Daniel Ltd sells one of its properties

Q58: The development phase is described in AASB

Q61: Which of the following are examples of