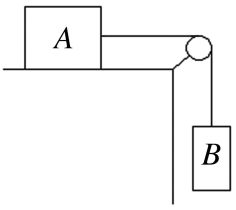

Two boxes are connected by a weightless cord running over a very light frictionless pulley as shown in the figure. Box A, of mass 8.0 kg, is initially at rest on the top of the table. The coefficient of kinetic friction between box A and the table is 0.10. Box B has a mass of 15.0 kg, and the system begins to move just after it is released.

(a) Draw the free-body diagrams for each of the boxes, identifying all of the forces acting on each one.

(b) Calculate the acceleration of each box.

(c) What is the tension in the cord?

Definitions:

Significant Influence

A level of power that allows an entity to affect the decision-making of another entity without full control, often associated with ownership of a significant but not majority share percentage.

Significantly Influenced

A situation where an entity has a notable but not controlling interest in another entity, impacting its financial and operating policies.

Associate

An entity in which an investing entity has significant influence, typically through owning a substantial but not majority shareholding, usually between 20% and 50%.

Other Comprehensive Income

Represents items of income and expense that are not realized through the profit and loss account, including gains or losses from foreign currency translation and changes in the fair value of investments.

Q1: In a previous period Banshee Ltd wrote-off

Q10: A roadway for stunt drivers is designed

Q10: Two bodies P and Q on a

Q20: Object A has a position as a

Q20: The binding energy of the hydrogen atom

Q36: Creative accounting violates IFRS standards and generally

Q38: AASB 108 (Accounting Policies, Changes in Accounting

Q38: The magnitude of the Poynting vector of

Q40: An airplane flies between two points on

Q59: The development of exit-price accounting (or CoCoa)