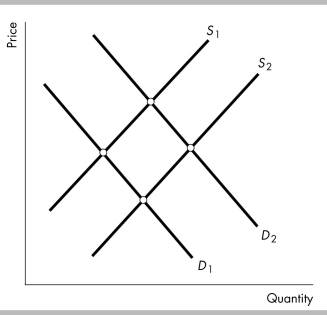

-The above figure shows the market for gasoline. When a hurricane destroys a major refinery that refines oil into gasoline, the

Definitions:

Marginal Tax Rate

The tax rate that applies to the next dollar of taxable income; the percentage of tax applied to your income for each tax bracket in which you qualify.

Taxable Income

The amount of income that is subject to tax, after all allowable deductions, exemptions, and adjustments.

Average Tax Rate

The ratio of the total amount of taxes paid to the total income, showing the percentage of income paid in taxes.

Progressive Tax

A taxation system where the tax rate increases as the taxable amount (income or profits) increases, making it proportionately more taxing on higher earners.

Q27: Explain why the number of substitutes influences

Q188: If a salesperson is paid by the

Q231: The greater the substitutability between Northwest timber

Q239: Over the past decade technological improvements that

Q283: Suppose that business travelers and leisure travelers

Q293: Redbox rents DVDs for $1 per day

Q314: The supply of lettuce in the short

Q340: Suppose the price of a football is

Q402: What will happen to the equilibrium price

Q408: The price of a good will fall