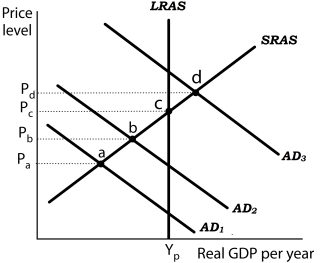

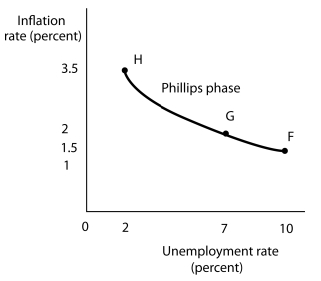

Figure 16-3

Panel (a) Panel (b)

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

Suppose the level of potential output (YP) is $1,000 billion and the natural rate of unemployment is 5%. In Panel (a) , the aggregate demand curve in Period 1 is AD1. Assume that the price level in Period 1 has risen by 1.5% from the previous period and the unemployment rate is 10%. Thus, in Panel (b) point F shows an initial rate of inflation of 1.5% and an unemployment rate of 10%. Similarly, point b in Panel (a) corresponds to point G in Panel (b) and point d in Panel (a) corresponds to point H in Panel (b) .

-Refer to Figure 16-3. In the Phillips phase of the inflation-unemployment cycle,

Definitions:

Book Value

The net value of a company's assets minus its liabilities, as recorded on the balance sheet.

Operating Costs

Expenses associated with the day-to-day operations of a business, including rent, utilities, payroll, and raw materials.

Useful Life

The estimated period that an asset is expected to be usable for its intended purpose, impacting depreciation calculations.

Variable Cost Concept

The principle that costs vary in proportion to the level of production or activity. These costs increase as production increases and decrease as production decreases.

Q7: Monetarists contend that a consistent relationship exists

Q10: A point at which the world is

Q12: In a recovery phase,<br>A) inflation and unemployment

Q27: Consider the following two events: (i) an

Q60: All of the following are consequences of

Q67: One distinguishing feature of new Keynesian economics

Q72: The World Bank predicts that world population

Q102: China's system of contracting all decisions to

Q121: As it relates to reform in former

Q217: According to the permanent income hypothesis,<br>A) a